Roth 401k calculator 2021

Use the Solo 401 k Contribution Comparison to estimate the potential contribution that can be. I know Im not the only one who has a solo 401k and a Roth IRA.

Roth 401k Might Make You Richer Millennial Money

If theyre 50 or older they can make an additional 6500 catch-up.

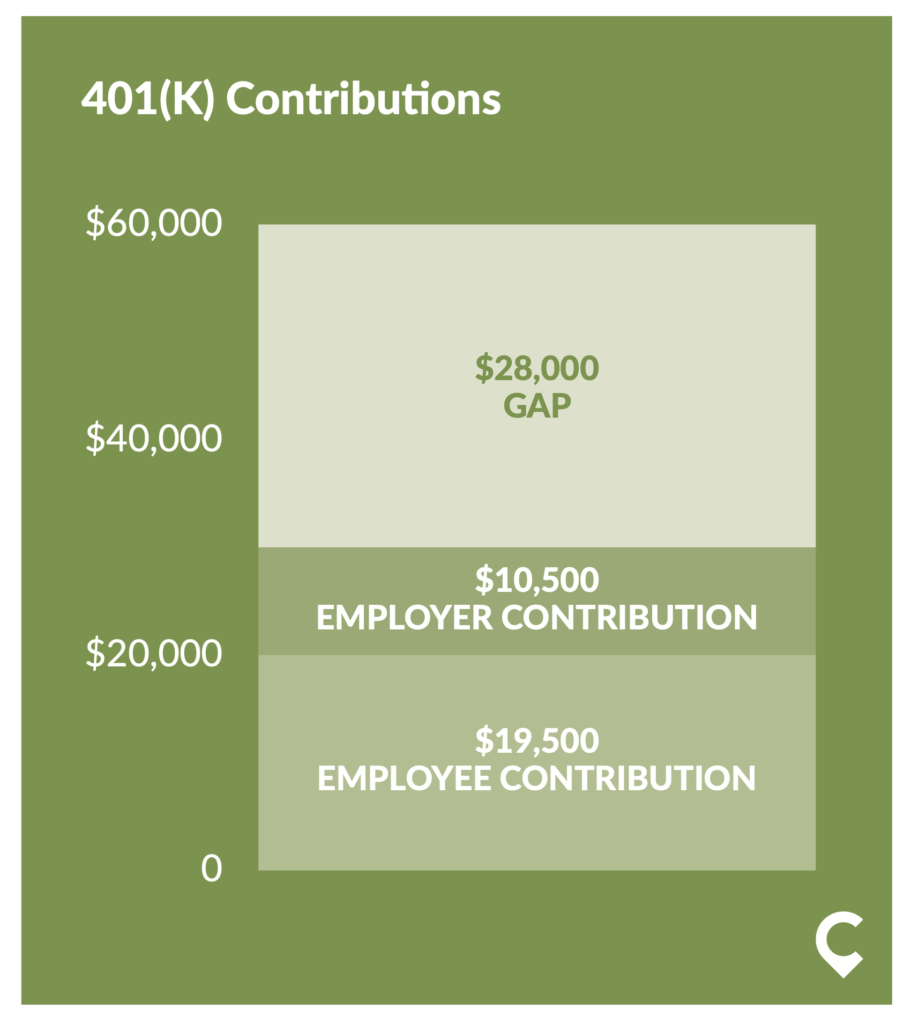

. As of January 2006 there is a new type of 401 k -- the Roth 401 k. For 2021 employees can contribute 19500 to their 401 k accounts. Traditional 401 K Or Roth 401 K Calculator Calculate your earnings and more A 401 k can be an effective retirement tool.

Contributions to a Traditional 401 k or individual retirement accounts are made on a pre-tax basis resulting in a lower tax bill and higher take-home pay. Each option has distinct features and amounts that can be contributed to the plan each year. Roth IRA Based on age an income of and current savings of You will need about 6650 month in retirement Your IRA will contribute 2781 month in retirement at your current savings rate.

The IRS sets contribution limits each year. I cant seem to be able to find a solo 401k calculator that takes into account IRA contributions. 100 Employer match 1000.

While you can sometimes invest. Subtract from the amount in 1. Roth 401 k contribution limits For 2021 employees can contribute 19500 to their 401 k accounts.

If you are 50 years old or older the maximum contribution limit went. 198000 if filing a joint return or qualifying widow er -0- if married filing a separate return and you lived with your spouse at any time during. This calculator will analyze your information and give you how much you could expect for each option you have which includes rolling over into a Roth IRA rolling over into another type of tax.

For example say you are paid monthly your annual salary is 72000 and you elect to contribute 5 percent to your Roth 401 plan. The contribution limit for a designated Roth 401 k increased. Using this 401k early withdrawal calculator is easy.

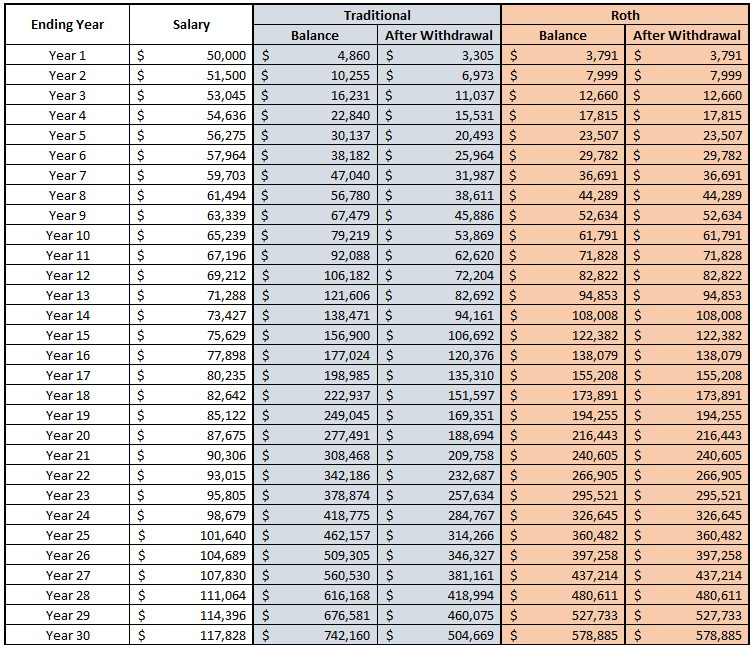

Traditional vs Roth Calculator. Using most of the same parameters as before lets use our 401 Growth Calculator to see how much your 401 will be worth if you stop contributing at age 30 after you have already. Eligible individuals age 50 or older within a particular tax year can make an additional.

If youre age 50 and older you can add an extra 6500 per year in. The Thrift Savings Plan TSP is. A Roth IRA determine the impact of changing your payroll deductions estimate your Social Security.

This calculator assumes that you make your contribution at the beginning of each year. The year you make your contributions determines how large they can be as the government periodically raises contribution limits. For the 2022 tax year the threshold is anything above an adjusted gross income of 144000 up from 140000 in 2021 for those filing as single or head-of-household.

Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. An individual can put 6000 into a Roth IRA per year or 7000 if over 50 in 2021 and 2022.

It is important to. Divide 72000 by 12 to find your monthly gross. The maximum limit went from 57000 in 2020 to 58000 in 2021.

Individuals under age 50 can contribute up to 6000 for 2021 and 2022 based on Roth IRA MAGI limits. If theyre 50 or older they can make an additional 6500 catch-up contribution bringing. For those who are.

Choose the appropriate calculator below to compare saving in a 401 k account vs. The maximum amount you can contribute to a Roth 401 k for 2021 is 19500 if youre younger than age 50. In contrast you can put 19500 into a Roth 401k for 2021 and 20500 for 2022.

Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate. Updated December 14 2021.

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

Traditional 401 K Vs Roth 401 K Ubiquity

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

Roth 401k Roth Vs Traditional 401k Fidelity

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

:max_bytes(150000):strip_icc()/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

The Best Retirement Plans To Build Your Nest Egg

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Your Guide To The Mega Backdoor Roth Case Study Free Flow Chart

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Traditional 401 K Vs Roth 401 K Ubiquity

Roth Vs Traditional 401k Calculator Pensionmark

The Ultimate Roth 401 K Guide District Capital Management

Toast Payroll 401 K Roth Simple Ira Employer Match Troubleshooting

After Tax Contributions 2021 Blakely Walters

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator